Motor Vehicle Tax

The motor vehicle tax is the main source of income for the Punjab government and has been managed by the Motor Vehicle Ordinance, of 1965 and the Motor Vehicle Tax Act, of 1958.

Vehicle owners can check their token tax and payment history by visiting MTMIS Punjab. It keeps them updated about their vehicle tax dues. This system also helps to manage token tax regulations smoothly. The government of Punjab provides a facility for calculating token tax by using an online token tax calculator.

Types of Taxes and Fees Related to Motor Vehicles

New registration fees, Luxury tax rates, Transfer fees, token tax motor car rates, rates of other post transactions, security featured items rates, rate of CVT, withholding tax rates, fees of motor tax on commercial vehicles, income tax rates, and rebate in token tax given below.

New Registrations

Rates of Transfer Fees

Lifetime Token at the Time of Transfer

- If the motorcycle is transferred within ten years of such registration then with a 10% annual discount, PKR 1500 fees shall be charged.

- If engine power up to 1000 cc is transferred within ten years of such registration then with a 10% annual discount, PKR 20,000 fees shall be charged.

Rates of Income Tax, Token Tax, Professional Tax for Motor Car

Rates of other Post Transaction

Rates of Security Feature Items

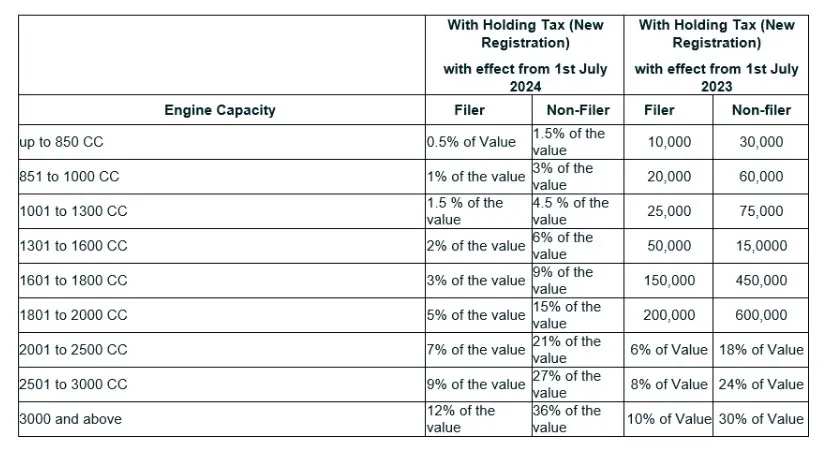

Rates of With Holding Tax With Effect from July 2023

Passenger Vehicle with Holding Tax with Effect from 1 July 2023

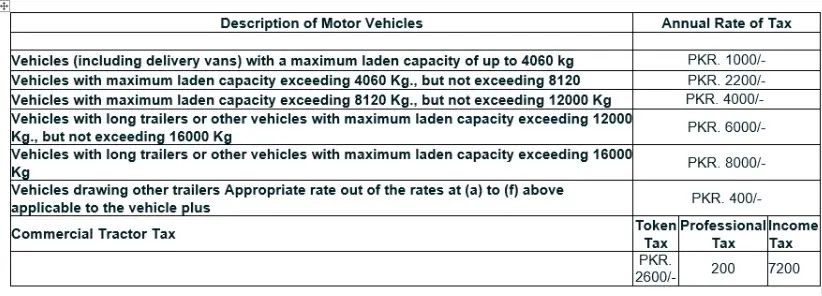

Rates of Motor Vehicle Tax (Token Tax) on Commercial Vehicles

Rates Of Motor Tax on Commercial Passenger Vehicles

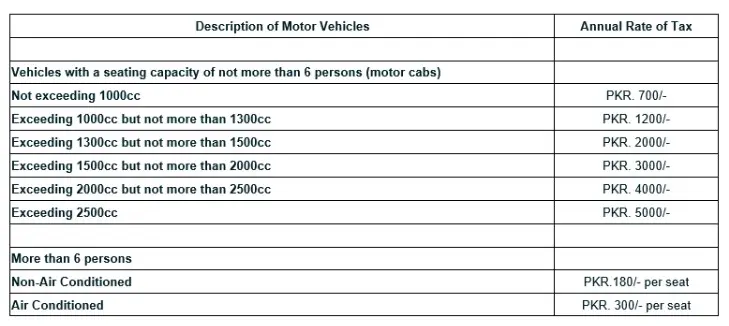

Rates of Motor Tax on commercial Motor Cabs

Rates of Motor Tax on Private Vehicles

Rates of income Tax

Rebate in Token Tax

Additional fees on new registration

Explanation:

- Vehicles that are under the use of the Federal or provincial government and are free from the additional fee.

- for vehicles brought in bulk by the manufacturer or authorized dealer, the timeline for registration of the vehicle starts when the dealer completes the sale of the vehicle.

- for transport vehicles, the registration timeline starts on the date the examiner issues the fitness certificate.

Importance of Motor Vehicle Taxes

- Generate income for government services and initiatives.

- Provide funding for the constructing and maintaining public infrastructure like roads highways and bridges.

- Support the expenses for repairing and managing the cracked roads.

- Set and manage rules for ownership and using vehicles.

- Managing overcrowding of vehicles on the roads.

- Support eco-friendly vehicles by offering incentives and taxing those who have more emissions.